Continuum Economics

US PPI and survey data may be USD supportive

EUR/USD more rangy but risks on the downside

AUD could benefit from solid employment data

NOK still has scope for recovery after strong GDP

US data unlikely to move markets

Japanese GDP may decline but JPY looking better supported

AUD weakness looks overdone

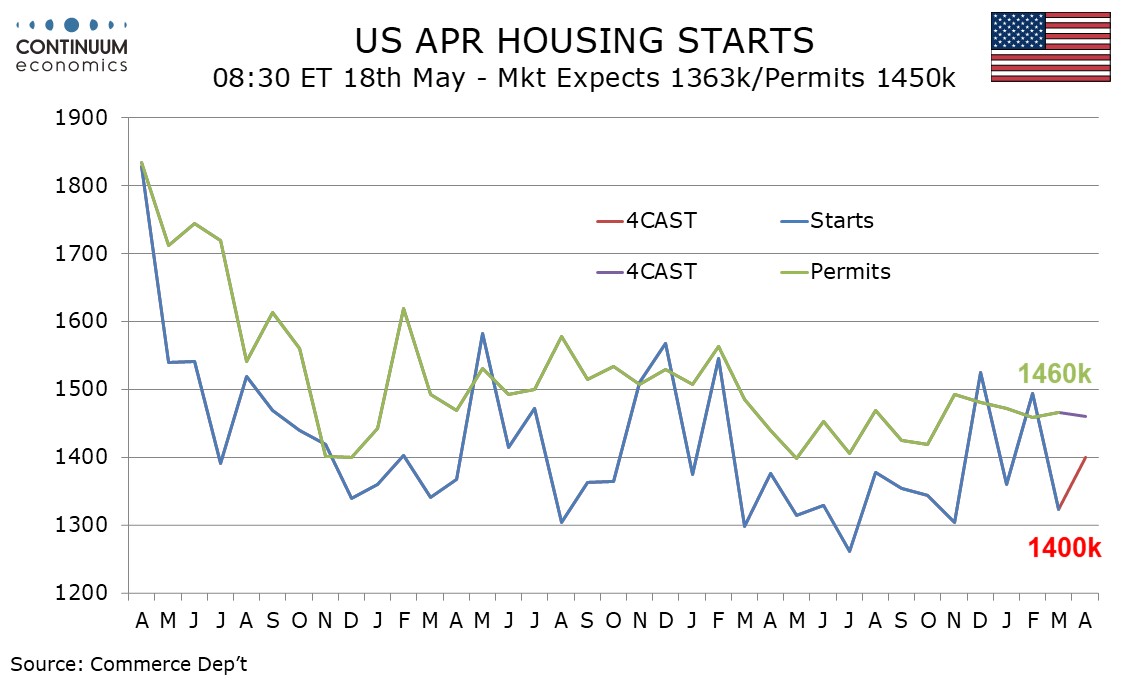

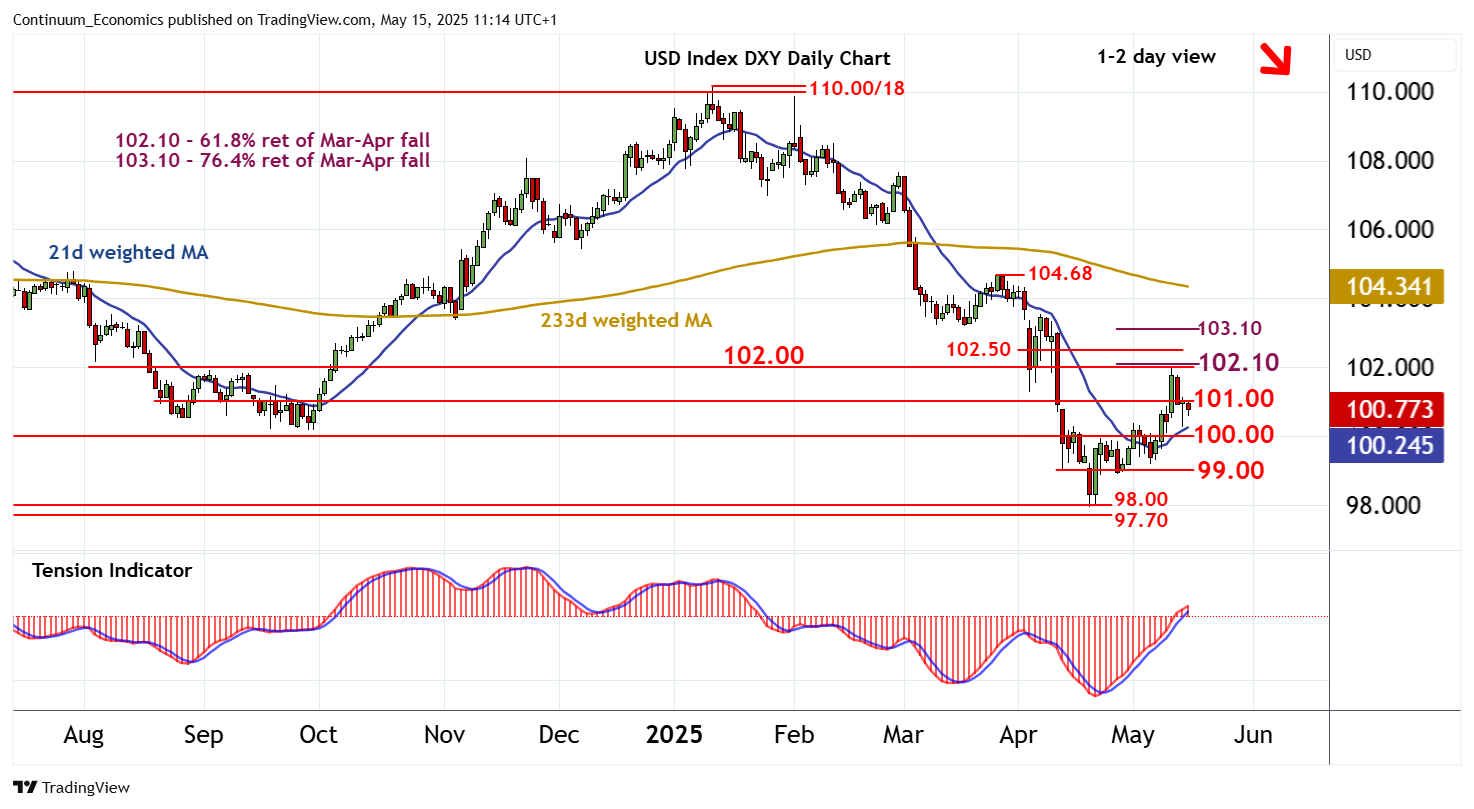

Friday is a relatively quiet calendar, with the April housing starts and May University of Michigan survey in the US, and Q1 GDP data from Japan. We expect April housing starts to rise by 5.7% to 1400k after a fall of 11.4% in March, while permits fall by 0.5% to 1460k after a 0.5% increase in March. While starts have been more volatile than permits in recent months, the trend continues to have little direction. Some recovery seems likely in the UMich survey, with inflation expectations also likely to decline, but neither report seems likely to have much market impact. At this stage the USD looks like stabilising close to current levels until we get more information on the impact that the tariffs are having on growth and inflation in the next couple of months.

The consensus for the Japanese GDP data is for a 0.1% q/q decline, which would mean Japan remains at the bottom of the G10 league table for growth since Q4 2019 – the last quarter before the pandemic. Some of this is due to a declining labour force, but the latest quarter comes after a stronger than expected Q4, so is unlikely to be seen as too damaging for longer term growth prospects provided it isn’t significantly weaker than expected.

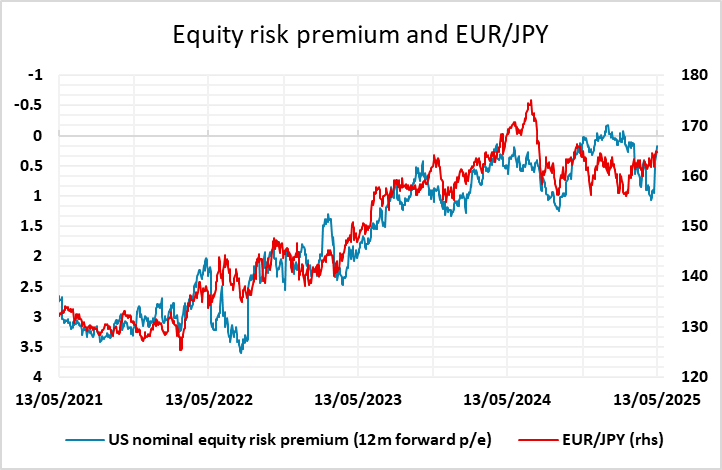

The JPY has managed a better performance in the last few days after sliding lower over the last month, helped by some softening of risk sentiment after the surge on the announcement of the reduction of US/China tariffs. We still see longer term upside scope for the JPY, as he current low level of US equity risk premia looks unsustainable in the longer run, and the positive correlation of the JPY with US risk premia is consequently likely to mean an extended JPY recovery medium term. But for now if US equities hold near current levels, as seems likely in the absence of further significant news, we would expect some stabilisation of the JPY near current levels.

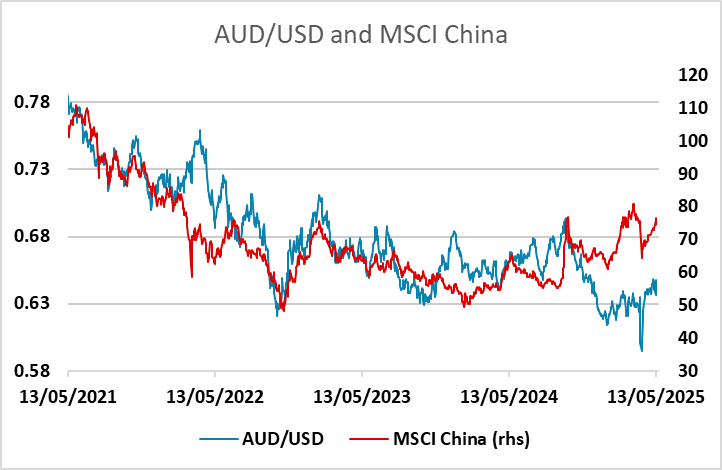

Most FX pairs look relatively stable, but it was notable on Thursday that AUD/USD fell back below 0.64 despite a very strong Australian employment report and relatively modest moves in equity and bonds markets. The AUD continues to look somewhat undervalued relatively to its usual relationship with yield spreads and equities, and the dip below 0.64 should prove a buying opportunity provided we don’t see equity markets move significantly lower near term.

Was this article displayed correctly? Not happy with what you see?

If you often open multiple tabs and struggle to keep track of them, Tabs Reminder is the solution you need. Tabs Reminder lets you set reminders for tabs so you can close them and get notified about them later. Never lose track of important tabs again with Tabs Reminder!

Try our Chrome extension today!

Share this article with your

friends and colleagues.

Earn points from views and

referrals who sign up.

Learn more

Save articles to reading lists

and access them on any device